Financial loan strategies Perform a significant position in enabling persons and corporations to accessibility financial aid for a variety of needs. No matter if It really is funding a brand new small business enterprise, acquiring a house, or masking sudden bills, comprehending the different sorts of personal loan schemes obtainable as well as their eligibility standards is critical. This short article delivers an summary of loan schemes, explores the application method, discusses the advantages and downsides, and presents tips on controlling personal loan repayments. Continue to be educated to help make educated conclusions When thinking about a personal loan plan in your economical requires.

one. Introduction to Bank loan Strategies

Definition of Mortgage Schemes

Welcome to the world of personal loan strategies, the place income matters get real! A personal loan plan is basically a flowery expression for the structured strategy that enables you to borrow money for several needs, no matter whether It is to buy a home, fund your company goals, or deal with yourself to your nicely-deserved holiday vacation.

2. Different types of Bank loan Techniques Obtainable

Secured vs. Unsecured Financial loans

In terms of financial loans, you've got selections. Secured financial loans demand some method of collateral (like your car or household) to again up the mortgage, when unsecured loans count on your creditworthiness. Pick out wisely, younger grasshopper.

Particular Financial loans

Require funds for a private project or even a unexpected price? Own financial loans are similar to a financial hug once you will need it most. Just make sure you pay out them back again, or points could get uncomfortable.

Business enterprise Financial loans

Bought big dreams for your company but brief on money? Enterprise loans towards the rescue! Regardless of whether you are commencing a fresh venture or expanding an present a person, these financial loans might be your ticket to entrepreneurial stardom.

Mortgages

Dreaming of the destination to connect with your individual? Mortgages are loans specially tailored for buying housing. They might make your homeownership goals a actuality, but be ready for a long-phrase commitment.

three. Eligibility Standards for Bank loan Schemes

Earnings and Credit history Score Specifications

Hello, It can be me, your pleasant neighborhood lender. To obtain that sweet loan approval, You'll have to indicate us The cash and verify you're a liable borrower with a good credit history rating. It really is similar to a monetary qualifications Verify.

Employment Status

Unemployed? That may make getting a personal loan a tad demanding. Lenders love to see that you've a secure work or maybe a reliable supply of income to ensure you can repay Whatever you borrow.

Collateral or Guarantor

In some cases, lenders want a backup program just in case points go south. Collateral (like your prized belongings) or a guarantor (a pal ready to vouch in your case) may give lenders relief and boost your likelihood of bank loan approval.

4. Application Procedure for Mortgage Schemes

Gathering Essential Documents

Prepare to dive into paperwork land! From pay back stubs to lender statements, You'll have to collect all the required paperwork to confirm you're a reputable borrower. It really is like adulting, but with a lot more types.

Publishing the Financial loan Application

Once you've dotted your i's and crossed your t's, it is time to submit that mortgage software. Imagine it as your fiscal resume – ensure It is polished and offers you in the ideal mild feasible.

Acceptance and Disbursement Approach

Drumroll, make sure you! When you've submitted your application, the personal loan gods will overview it and either bless you with acceptance or send you back again towards the drafting board. If accepted, you'll shortly see These cash magically seem in the account. Just bear in mind, it isn't really cost-free money – You will need to pay for it back by using a facet of interest.### 5. Added benefits and disadvantages of Bank loan Strategies

#### Execs of Mortgage Strategies

Financial loan techniques can provide Significantly-wanted financial support, whether for acquiring a home, starting off a company, or funding instruction. They offer a structured repayment strategy and will help Create credit history record when managed responsibly.

#### Cons of Loan Schemes

Around the flip side, loans come with desire payments and costs, which can increase the overall amount repaid. Failure to create well timed payments may lead to penalties, destruction your credit history rating, and in some cases cause legal motion.

### six. Controlling Bank loan Repayments

#### Creating a Repayment Plan

Acquiring a sensible repayment prepare will help you stay heading in the right direction with the bank loan payments. Budgeting month to month installments together with your other monetary obligations is essential to averting late payments.

#### Options for Personal loan Restructuring

For anyone who is struggling to fulfill your repayment obligations, contemplate speaking about restructuring alternatives with your lender. This might involve extending the financial loan term, shifting the repayment schedule, or consolidating many financial loans into one particular.

#### Impact of Late Payments

Late payments can incur added fees and curiosity, tarnish your credit rating rating, and allow it to be more durable to safe upcoming credit score. Prioritize well timed repayments to take care of a constructive economical standing.

### 7. Tricks for Choosing the Correct Bank loan Plan

#### Assessing Desire Fees and Fees

Evaluate curiosity costs and charges throughout unique lenders to settle on a personal loan plan which offers probably the most favorable terms. A reduce interest price can lead to considerable personal savings in excess of the life of the mortgage.

#### Comprehension Stipulations

Totally read through and recognize the stipulations from the loan settlement in advance of signing. Concentrate to prepayment penalties, repayment schedules, and any hidden rates that will affect your finances.

#### Trying to get Qualified Suggestions

When in doubt, search for assistance from monetary advisors or personal loan authorities. They can provide precious insights, enable you to navigate complex financial loan terms, and make sure you make educated choices about your borrowing demands.

### eight. Potential Traits in Mortgage Strategies

#### Technological Developments in Financial loan Processing

Improvements in engineering, which include on the internet akhuwat loan apply online purposes and electronic verification processes, are streamlining the mortgage acceptance system and making it a lot more easy for borrowers to access credit score.

#### Affect of Financial Tendencies on Personal loan Availability

Economic circumstances Engage in a big job in shaping The provision and conditions of loan schemes. Keep an eye on industry developments and curiosity charge fluctuations to generate knowledgeable selections about borrowing in the transforming money landscape.In summary, bank loan strategies could be effective resources for attaining your economic objectives, but it's important to solution them with caution and knowing. By very carefully assessing your preferences, Discovering the obtainable choices, and running repayments responsibly, you could take advantage of of mortgage techniques even though steering clear of possible pitfalls. Continue to be knowledgeable, seek assistance when essential, and choose the appropriate mortgage plan that aligns along with your financial aims.

Mr. T Then & Now!

Mr. T Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Taran Noah Smith Then & Now!

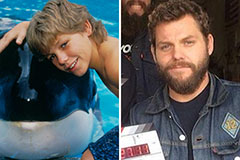

Taran Noah Smith Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!